How much home can you afford?

Now that you have a clear picture of your current financial situation, it’s time to find out what you can afford in monthly housing costs. Lenders follow two simple affordability rules to determine how much you can pay.

The first affordability rule is that your monthly housing costs shouldn’t be more than 39% of your gross household monthly income. Housing costs include monthly mortgage principal and interest, taxes and heating expenses—known as P.I.T.H. for short. For a condominium, P.I.T.H. also includes the monthly condominium fees.

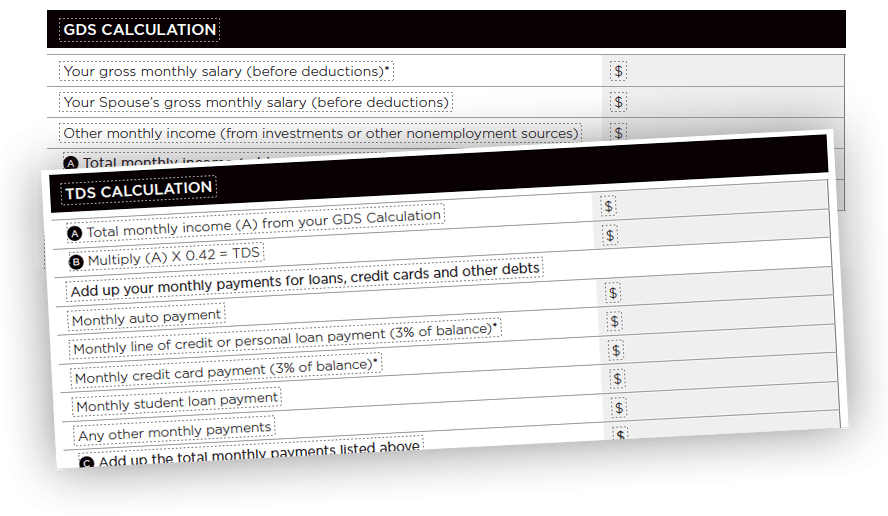

Lenders add up these housing costs to determine what percentage they are of your gross monthly income. This figure is known as your Gross Debt Service (GDS) ratio. Remember, it must be 39% or less of your gross household monthly income.

Calculating your Gross Debt Service & Total Debt Service Ratios

Use our free home owners guide to dial in your GDS and TDS ratios.